Aspen Capital Fund invests in North American companies with owner earnings of $50,000 to $1.5Million per year. As a support ecosystem we provide advice, education,and experience.

Investors

……..

Self-made entrepreneurs.

Creating emerging wealth.

Do you want to learn how to get in the hot market of direct investing?

Now you can learn to use a consistent method for vetting opportunities, define a strike zone, and get access to our opportunity deal flow.

Are you interested in making investments in businesses but don’t know where to start?

Are you tired of sitting on the sidelines, and missing opportunities? Here at Aspen Capital Fund we help self-made entrepreneurs learn how to analyze businesses, develop a focus that works for you, and share our active deal flow.

Join our group that is creating generational wealth.

Get access to the FREE Direct Investing e-Book.

Become part of our unstoppable investors network.

View our proactive deal flow as an investor.

Align your investment strategy with venture ready entrepreneurs and established businesses. Are you investing without a strategy, without a focus, with no defined strike zone?

Let us introduce you to our best prepared venture ready entrepreneurs.

Use a consistent method for vetting opportunities. Know what deals you should be investing in and why with a direct investment deal flow.

We offer companies that are…

Ideal niche sectors that are big enough to be economically interesting.

Have enterprise value of at least $500,000.

Offer control or minority equity investments.

Provide opportunity for sellers to retain significant equity upside.

Planned investment horizon of 3 to 7 years.

Why Aspen Capital Fund Opportunity Deal Flow?

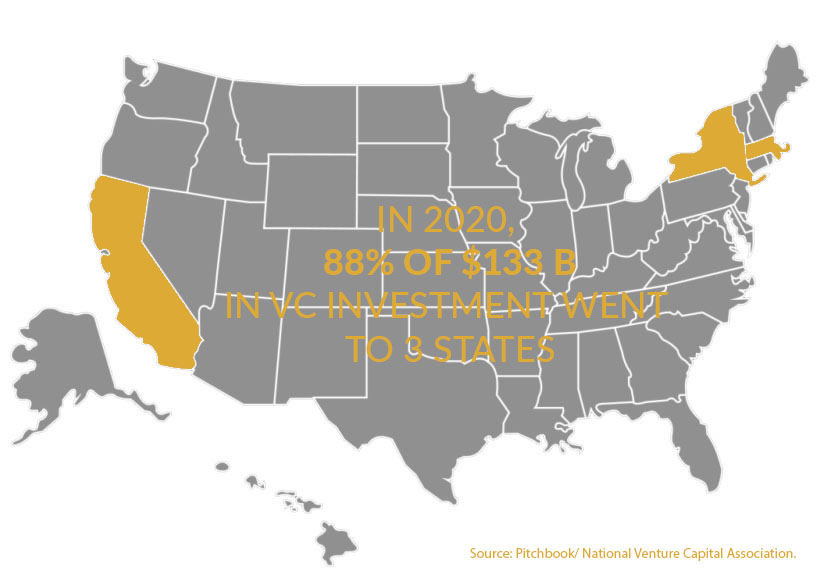

Funding for startups is concentrated in just three states – California, New York, and Massachusetts. Despite record levels, these three states account for 80% of the total dollars committed in later-stage companies.

Startup ecosystems around the country are suffering because of this concentration of funding activity. Founders across the country struggle to find funding. Investors are not rewarded on the same level with the amount of risk they assume. It’s an outdated and antiquated process.

There is a funding gap, and the current process needs to innovate.

The Venture Fund Problem

Venture Funds today:

- High Fees – 2 and 20 fee structure.

- Inefficient – Long funding cycles.

- Tax – Few account for tax incentives.

- Reporting – inconsistent, if any, standardized reporting.

Because of this venture capitalists (VCs) are forced to find a “unicorn”, that rare opportunity. This creates an assumption of risk that contributes to underperformance. The funding cycle requires intense due diligence and is completed on a deal-by-deal basis. Plus, fee structures create perverse incentives.

Unstoppable Investors at Aspen Capital Fund

Our unique solution will accelerate funding for businesses in underserved areas while improving outcomes for the investor. Utilizing often overlooked tax laws along with an entirely new approach that more closely mirrors the public markets, our process will change the way investors think about venture capital. Rather than the deal-seeking we see today, investors will be building generational wealth. We have named it Unstoppable Investors.

While this structure was originally designed to serve a growing interest in place-based impact investing. Because of this, our platform is applied to thematic funds, focusing on (female-founded, Hispanic-founded, startups).

Deliberate Process

The foundation of our process is transparency, utilizing Aspen Capital Fund investor relations services. A transparent and disciplined process is a necessary component to optimize outcomes for businesses and investors alike.

Businesses

-

Consistent expectations

-

Concrete funding milestones

Investors

● Company specific analytics

● Portfolio level overview

Our Target businesses

At Aspen Capital Fund we seek businesses that endure because they consistently solve a meaningful problem and are patiently built over decades. Their clients, communities, and employees trust their reliability, integrity, and craftsmanship. They won’t disappear with trends, or fads.

Our portfolio businesses aren’t stagnant; they’re specialists. They’re not looking for quick PR hits, a flashy new product to “save” the company, or to make a move merely to create the illusion of progress. They are perfectly fine to do the same thing day in-and-out, refining their expertise, systems, and service. And, through that commitment to excellence they profit.

When we invest, our first responsibility is to not screw things up. Post-close we like to ask questions, listen, and understand, not make sweeping changes and big promises. While no business is flawless, the business was successful before us and should be successful without us.

With that said, we try to help if and when we can be helpful. Looking at thousands of small companies a year and working across a diverse portfolio, we have an unusual vantage point. We’re able to see trends across industries and pick up some useful tricks. When we see an opportunity for improvement, our first step is always a conversation with leadership. Most often, our idea has been previously considered and attempted. But occasionally, we’re able to shine the spotlight on something new, and from there it becomes a collaboration in creating strategy and allocating resources.

[1]

Qualified Small Business Stock Tax Information

Qualified Small Business Stock (QSBS) treatment of angel investments are often overlooked as tax codes that can incentivize investors by reducing the after-tax risk and raising the after-tax returns.

- 1244 – Loss Treatment

Losses are above the (AGI) line deductions. Shareholders can deduct QSB stock as ordinary losses should the startup fail. With charitable donations treated as below the line deductions, a startup investment is a better tax break!

Requirements

Applies to individuals 1 investing in a C-corp startup. Must invest in the first $1M of capital in an equity-like instrument.

- 1202 – Gains Treatment

Profits from exits are 100% tax free. Permanent tax exclusion of 100% of gains on the sale or exchange of QSB stock acquired after September 27, 2010 and held for more than 5 years. $10 million limit on exclusion for each transaction.

Requirements

Applies to individuals 1 investing in a C-corp startup. Startup must make a product (not a service business).

1045 Exchange – Gains Rollover

- 1202 gains can be reinvested tax free. Shareholders can roll over capital gains from the sale of QSB stock pre-tax if other QSB stock is purchased. Five-year holding period for 100% tax exclusion under §1202 can be met with a holding period of new investments.

Requirements

Applies to individuals 1 investing in a C-corp startup. Must reinvest within 60 days from exit into another QSB.

1 Investors must invest directly or via a pass-through entity such as an LLC or revocable trust into an equity-like instrument such as preferred stock or a convertible security. Investing through a debt instrument such as a convertible note does not qualify.

The Aspen Capital and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

[1]

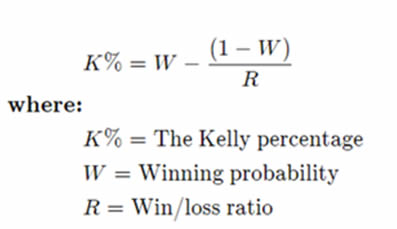

The Basics of the Kelly Criterion

There are two basic components to the Kelly Criterion. The first is the win probability or the probability that any given trade will return a positive amount. The second is the win/loss ratio. This ratio is the total positive trade amounts divided by the total negative trade amounts.

These two factors are then put into Kelly’s equation which is:

The output of the equation, K%, is the Kelly percentage, which has a variety of real-world applications. Investors can use it to determine how much of their portfolio should be allocated to each investment.